30/06/2022

We share this report published a few days ago in the digital media Innovaspain.com. The article makes a good diagnosis of the current situation of the telco sector and of the debates that will be put on the table in the framework of DigitalES Summit 2022.

Source: https://www.innovaspain.com/digitales-summit-espana-telecomunicaciones-redes-5g-telefonica/

What if Spain ceased to have the best telecommunications in Europe?

The telco sector is going through a delicate financial moment that is encouraging corporate movements. Future of the industry will be one of the topics of discussion at DigitalES Summit 2022

Density, speed and interconnection. These are the three elements that give value to a telecommunications network and Spain scores well in all three: the investments made by the private sector since its liberalization in 1998, the decisive drive of the public sector to reach dispersed and rural populations, and its unique geographical location as an intercontinental communications hub.

More specifically, Spain is the European market in which the deployment of fiber to the home (FTTH) is most advanced. According to an Oliver Wyman report published earlier this year, this technology is installed in 77% of Spanish homes, well ahead of the European average of 44%.

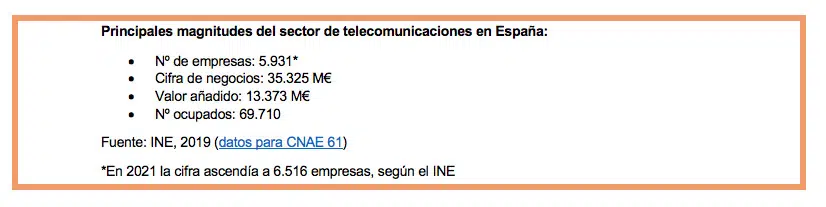

This is complemented by a network of 37 of the 436 submarine fiber optic cables in the world, satellite communications operators and a large base of deployment and maintenance specialists. In total, the telecommunications sector is made up of more than 6,000 companies in our country.

This telco strength represents a very important competitive advantage for Spain in a global economic environment where technology plays an increasingly important role. As José María Álvarez-Pallete, the new president of the GSMA, said during MWC Barcelona, “telecommunications are the gateway to the future”.

However, the telco sector is going through a particularly complex period, which raises the question of whether Spain will be able to maintain this advantageous position in the coming years. Thus, despite the fact that data traffic in the world is growing by up to 50% per year and that citizens are contracting more and more connectivity services, network operators’ margins are being progressively eroded, resulting in intensified competition throughout the industry.

According to calculations by the consultancy Oliver Wyman, operators lose about €1 billion in revenue per year due to the hypercompetitiveness installed in the market since 2018, making it difficult to implement the 5G investment cycle. Factors such as rising electricity prices and inflation, aggravated by the war in Ukraine, will further deteriorate the finances of companies forced to invest for the long term… when the long term has never been more uncertain.

Mergers, acquisitions and new business strategies

In this context, corporate movements are intensifying in search of synergies and other efficiencies, as well as new commercial strategies, in order to achieve a more recognized differentiation in the market in response to high customer turnover (or churn).

“Today, telecommunications operators are seen as supporting utility players and not as levers of general economic development and technological development in generalThe “new” companies have been created in favor of companies where the product is the users’ data,” said Javier Nadal, former director general of Telecommunications and current president of the Spanish Association of Foundations (AEF), during a breakfast organized recently by the Spanish Association of Telecommunications Engineers (AEIT) in Madrid.

Some of these corporate moves are being made by large network operators – the Orange-MásMóvil merger is the most talked-about – but others affect – or will affect – tower companies, integrators, manufacturers and other players in the telecommunications sector.

Regulatory changes

Finally, the health of the telecommunications industry is closely linked to the regulatory framework in force, and there are currently significant changes and proposals for regulatory changes. Among the first, the recently approved General Telecommunications Law, which incorporates improvements aimed at streamlining deployment permits and improving coordination between public administrations.

And among the latter, the European Commission’s recent approach that large digital content platforms such as Facebook, Twitter, Netflix or Amazon can participate in the investment in the networks through which they operate.among other proposals to ensure that the economic benefits of digital activity are shared equitably.

At the same time, some new business opportunities are on the horizon, which we will start to see coinciding with the massification of 5G stand-alone or with the spectrum auction of the 26Ghz band, which will catapult the Internet of Things in Spain.

In view of the above and the numerous unknowns, the immediate future of the telecommunications market in Spain is difficult to foresee. Not so the consequences of losing the current competitive advantage position.

DigitalES Summit 2022

These challenges and opportunities will be discussed during the upcoming DigitalES Summit 2022 on July 6, 7 and 8. Among the personalities confirmed for this congress are many of the top executives of the telecommunications business, as well as the top representatives of the main competent administrations. Among them, the First Vice President and Minister of Economic Affairs and Digital Transformation, Nadia Calviño; the Secretary of State for Telecommunications and Digital Infrastructure, Roberto Sánchez; and the President of the CNMC, Cani Fernández.

More information: www.digitalessummit.es

Previous articles:

> 10 key innovations for Spain’s strategic autonomy, according to DigitalES (innovaspain.com)

> This is how the technology industry plans to save our planet (innovaspain.com)